Energy Industry Update: Energy Prices Rise as Inflation Rate Breaks Records

Energy Costs Consumer Price Index Hits Historic Increase

The Bureau of Labor Statistic’s Consumer Price Index (CPI) reached 8.5% in March—the largest 12-month jump since 1981. Virtually every component of the CPI is more expensive than it was a year ago. The Federal Reserve responded to these alarming trends on May 4 with a 0.5% increase to its benchmark interest rate, with further increases to fight inflation inevitably on the way.

Inflation increases the prices we see at the grocery store, in the housing market, and at the pump. Energy costs for individuals will only rise this summer—when electricity demand is typically at its peak (tied to AC usage). As energy prices rise and the inflation rate breaks records, there is no better time to increase our usage of renewable energy, particularly when paired with energy storage (i.e. solar-plus-storage).

An Overview of Inflation, Price Volatility, and the Energy Market Today

Energy markets are not isolated from this inflation–and in many cases, the energy markets play a central role in driving inflation. Consumers, community members, and businesses are seeing higher oil, natural gas, and electricity prices across the board and forecasts continue to highlight expected volatility and ongoing increases.

For example, oil has moderated somewhat from its March high but is still almost double the price that it was a year ago. Gasoline prices peaked at approximately $4.30 per gallon. With summer travel season approaching, all eyes are on the market forecasts.

Wholesale natural gas spent most of the past decade around $2-4 per MMBtu but the main benchmark is touching $9, a level not seen in fourteen years. Recovering from domestic demand, supply is struggling to ramp up after a glut hammered the industry between 2020 and 2021. The recent pressure that has come from Russia invading Ukraine has only exacerbated these trends and the near-limitless demand for imports in Europe.

We are also seeing an increase in volatility: fluctuations are driven by predicted summer temperatures and reporting on how much gas is in storage. Many businesses are already facing high gas prices directly, whether for heating or as a feedstock for chemicals, fertilizers, or plastics.

Additionally, 40% of U.S. electricity is generated from natural gas. In some parts of New York and Florida, over 70% of electricity comes from natural gas. New York customers with wholesale electricity exposure saw day-ahead prices of $54 per MWh, more than double the $25 average in March 2021. Most electricity customers are not yet seeing the full effect of these price rises—they may be on a fixed-price contract or benefiting from the long-term contracts or hedging of their utility or supplier. Those measures can only go so far and a hotter-than-average summer is predicted. These higher temperatures and increases in demand will likely push wholesale prices even higher and flow through into electricity bills.

The Impact of the Climate Crisis on Energy Prices: Spotlight on Texas

Over the weekend, The Electric Reliability Council of Texas (ERCOT) issued a warning for possible emergency weather conditions as temperatures continue to rise across the state. Supply and demand are the name of the game in this especially volatile market and as the nation saw last year, unmet supply and lapses in power can have life-threatening consequences. “Recent grid failure during extreme heat has exposed 68% to 100% of the urban population to an elevated risk of heat exhaustion and heat stroke,” reported the Fort Worth Star-Telegram.

Thankfully, the weekend saw no power outages. In anticipation, ERCOT asked companies that can generate electricity to help support the rise in temperatures. As temperatures reach over 100 degrees, the demand for electricity to cool houses, workplaces, and other vital services such as hospitals spikes.

While there were no weekend outages, ERCOT is not completely out of the woods. Temperatures are expected to continue at record numbers, putting atypical strain on the electric grid. The warning has been extended throughout the week and no clear end is in sight.

Hedging Against Volatility with Energy Storage and Solar-Plus-Storage

A more modern, digital, and distributed grid is emerging to meet the moment, one that allows for more independence and flexibility.

Without energy storage electricity must be produced and consumed exactly at the same time. Energy storage systems allow energy to be stored—and then discharged—at the most strategic times. Today, lithium-ion batteries, the same batteries that are used in cell phones and electric vehicles, are the most commonly used type of energy storage. Like the batteries in your cell phone, commercial-, industrial-, and utility-scale battery energy storage systems can be charged with energy from the grid when it is cheapest, stored, and discharged when it is most expensive.

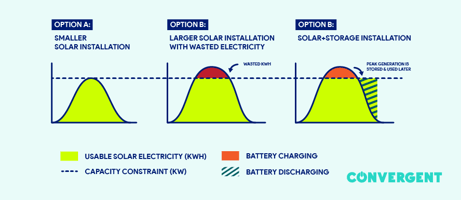

Increasingly, battery energy storage is being paired with solar PV, which maximized the value of solar energy to the grid, a solution known as solar-plus-storage. Solar panels only generate electricity when the sun is shining but we do not only use electricity when the sun is out. This is why finding a way to reliably store and access those electrons (i.e. energy storage) is key to the clean energy transition. A solar-plus-storage system is a battery system that is charged by a connected solar system and can reduce a customer’s energy costs and carbon footprint at the same time.

Industrial- and utility-scale energy storage and solar-plus-storage solutions can contribute to a winning energy strategy that helps organizations hedge against rising energy prices and price volatility. Energy storage-led solutions are the catalyst for a smarter, agile new world.

Convergent has over a decade of expertise developing energy storage and solar-plus-storage systems and can help you discover if either of these solutions are right for you. If you’d like to learn more about how energy storage can reduce your organization’s electricity costs, and insulate against price volatility, and accelerate the clean energy transition, please contact us today.

Peter Cavan is responsible for go-to-market strategy and execution in Convergent’s greenfield markets.

Prior to joining Convergent, Peter was manager of regulatory affairs at Centrica Business Solutions, where he led North American policy advocacy across demand response, solar and storage, and cross-cutting DER issues. His priorities included fair wholesale market access (arguing for 841/2222 at FERC and implementing at ISOs) and state-level support for clean and distributed energy.